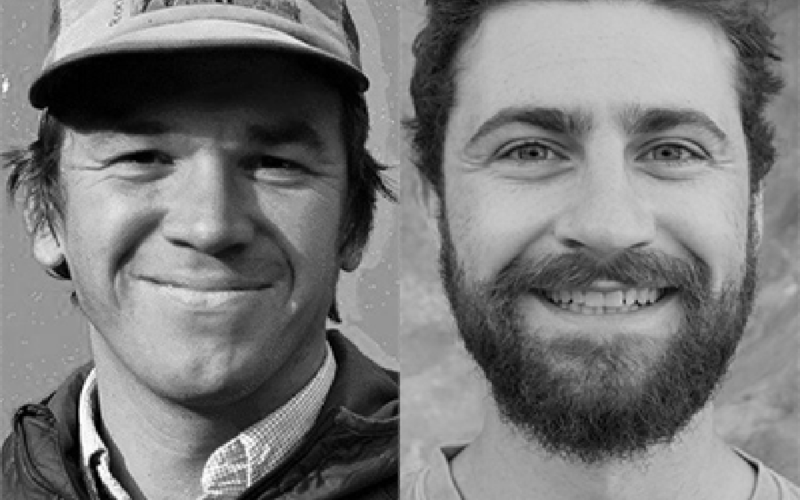

Stephen Hohenrieder on investing in mature food companies and help them go further and deeper

Stephen Hohenrieder, founder of Grounded Capital Partners, joins us to discuss a different approach to capital—by treating the symptoms of an unhealthy system rather than incentivizing them.