Paul McMahon – With over $500M invested, there is a regenerative edge of about 1-3%

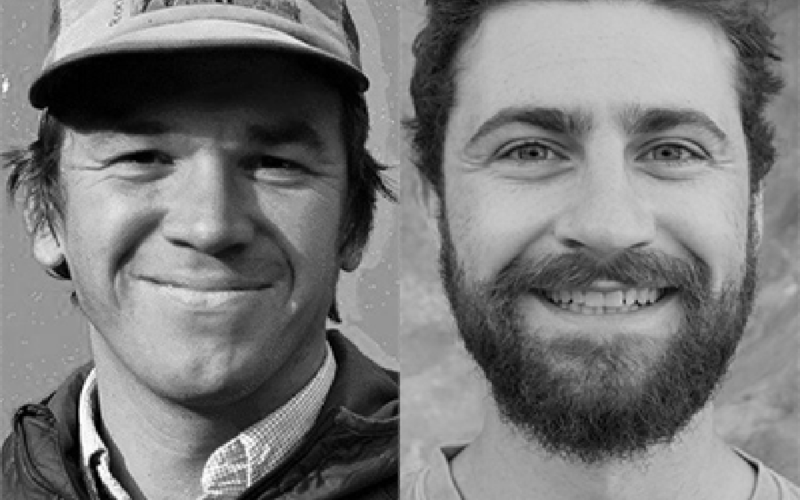

A conversation with Paul McMahon, co-founder of SLM, about why it makes so much sense to put money to work in real regenerative agriculture, yields, and more importantly, profits and the regenerative edge, and more.

Few papers in regenerative agriculture have been shared more than the Investment Case for Ecological Agriculture written by Paul McMahon. We have shared it countless times, learned a whole lot from the simple investment terms describing why it makes so much sense to put money to work in real regeneration. Now it has been updated, even better, it has been completely rewritten and with a lot more science and a lot more experience from the field.

In the conversation with one of the most experienced regenerative farmland investors, we explore the modules of our recent video course on why we need to change agriculture and food systems urgently, and why now is the time to do it.